Little Known Questions About Feie Calculator.

Wiki Article

Things about Feie Calculator

Table of ContentsGetting The Feie Calculator To WorkMore About Feie CalculatorThe Best Guide To Feie CalculatorSome Known Details About Feie Calculator Little Known Facts About Feie Calculator.

He sold his United state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his other half to aid accomplish the Bona Fide Residency Examination. Furthermore, Neil safeguarded a lasting home lease in Mexico, with strategies to eventually acquire a home. "I currently have a six-month lease on a residence in Mexico that I can prolong one more 6 months, with the objective to buy a home down there." Nonetheless, Neil mentions that buying residential or commercial property abroad can be testing without first experiencing the location."We'll definitely be outdoors of that. Also if we come back to the United States for doctor's consultations or service phone calls, I doubt we'll invest more than 30 days in the United States in any kind of provided 12-month period." Neil emphasizes the importance of strict monitoring of united state brows through (Digital Nomad). "It's something that people need to be truly diligent about," he claims, and advises expats to be careful of typical blunders, such as overstaying in the united state

The Best Guide To Feie Calculator

tax obligation commitments. "The reason U.S. taxation on around the world income is such a big deal is because lots of people forget they're still subject to U.S. tax obligation also after relocating." The U.S. is one of the few countries that taxes its citizens no matter where they live, indicating that also if a deportee has no revenue from U.S.income tax return. "The Foreign Tax obligation Credit history permits individuals operating in high-tax nations like the UK to counter their united state tax obligation liability by the amount they've already paid in taxes abroad," says Lewis. This guarantees that expats are not taxed twice on the very same revenue. Those in reduced- or no-tax nations, such as the UAE or Singapore, face additional difficulties.

The Best Strategy To Use For Feie Calculator

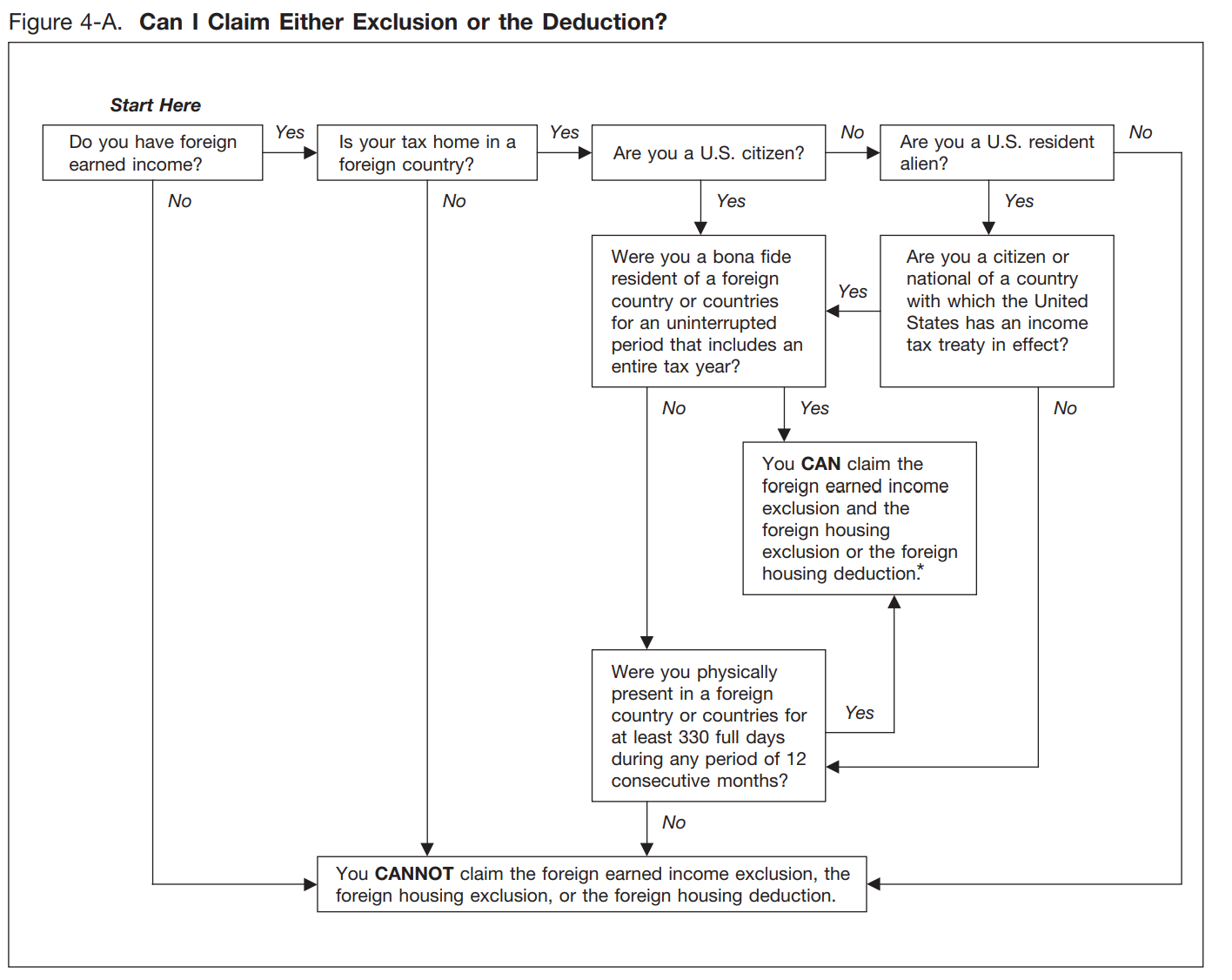

Below are several of one of the most frequently asked questions concerning the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) allows U.S. taxpayers to leave out approximately $130,000 of foreign-earned income from federal earnings tax obligation, decreasing their united state tax responsibility. To receive FEIE, you need to fulfill either the Physical Presence Test (330 days abroad) or the Bona Fide Residence Test (show your main home in an international nation for a whole tax obligation year).

The Physical Presence Test requires you to be outside the U.S. for 330 days within a 12-month period. The Physical Existence Examination also requires U.S. taxpayers to have both a foreign earnings and a foreign tax home. A tax obligation home is specified as your prime area for service or employment, no matter he has a good point your family's residence.

The 15-Second Trick For Feie Calculator

An income tax obligation treaty in between the united state and another nation can help prevent dual tax. While the Foreign Earned Earnings Exemption minimizes taxed earnings, a treaty may supply fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed filing for U.S. citizens with over $10,000 in international economic accounts.Qualification for FEIE depends upon meeting particular residency or physical presence examinations. is a tax consultant on the Harness platform and the founder of Chessis Tax obligation. He belongs to the National Association of Enrolled Representatives, the Texas Society of Enrolled Agents, and the Texas Society of CPAs. He brings over a years of experience helping Huge 4 companies, recommending migrants and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation expert on the Harness system and the founder of The Tax Dude. He has more than thirty years of experience and currently concentrates on CFO solutions, equity payment, copyright tax, cannabis taxation and separation relevant tax/financial preparation matters. He is an expat based in Mexico - https://www.quora.com/profile/FEIE-Calculator.

The foreign made income exemptions, in some cases referred to as the Sec. 911 exclusions, leave out tax on incomes made from working abroad.

The Basic Principles Of Feie Calculator

The tax obligation advantage leaves out the revenue from tax obligation at lower tax obligation prices. Formerly, the exclusions "came off the top" lowering income topic to tax at the top tax obligation prices.These exclusions do not spare the wages from US tax however merely supply a tax obligation reduction. Keep in mind that a single person working abroad for every one of 2025 that earned regarding $145,000 without other earnings will certainly have gross income reduced to absolutely no - successfully the very same response as being "free of tax." The exclusions are calculated on a day-to-day basis.

Report this wiki page